Innovating Non-Clinical Testing: NAMs and ESG Impact

Published Jul 21, 2025

Published 26th March 2024

Over the past five years, an average of 30 to 40 medications have received approval from the Food and Drug Administration (FDA). Each of these products has undergone rigorous evaluation to ensure safety and efficacy before entering the market. The approved medications encompass a diverse range, including biologics, chemotherapy agents, generics, and novel chemical entities.

While many people associate new drug development with large pharmaceutical companies like Pfizer, Moderna, and AstraZeneca—organizations with substantial resources and thousands of employees—it’s essential to recognize that smaller players also play a crucial role. These smaller pharmaceutical companies, often comprising fewer than 50 employees, as well as medium-sized companies (with up to 500 employees) and academic research institutions, contribute significantly to addressing unmet medical needs by developing innovative products. Their efforts lead to breakthroughs that benefit patients worldwide.

When it comes to developing medications, one of the primary differences lies in the composition of the teams involved. Smaller pharmaceutical companies and entities often handle early development activities, such as discovery and preclinical research. However, there comes a point where these smaller players may lack sufficient funds, expertise, or understanding of the drug development process to advance their programs.

The pivotal question arises: Should these companies hire new employees to fill these roles? The answer lies in considering outsourcing as a viable solution. By leveraging external expertise, companies can access specialized skills, reduce costs, and maintain flexibility in their operations. Outsourcing becomes a strategic decision point that allows smaller entities to focus on their core competencies while tapping into a broader network of talent.

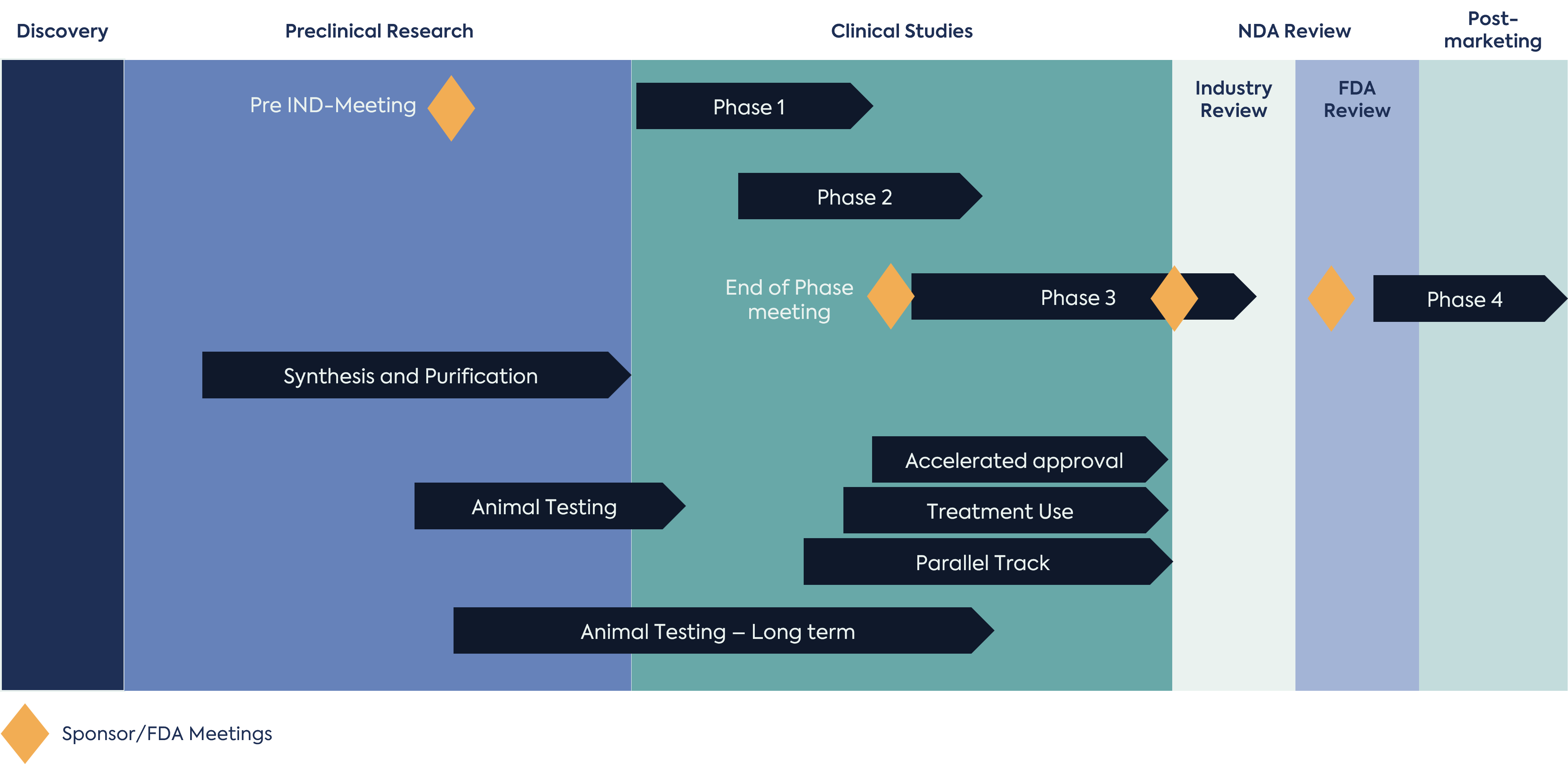

Drug Development is a rather complex process that requires careful orchestration as several activities occur simultaneously. Looking at the Figure 1 provides an overview of the typical drug development process. Invariably, the discovery team faces and overcomes many challenges prior to interacting with the FDA during an INTERACT Meeting, Pre-IND meeting or at the time of IND submission before initiating a clinical study. It should be noted that most, if not all, drug development programs go through multiple fundraising phases. Fundraising is critical to successful product development. Without funding the drug development process may fail before it even begins. Resource allocation and availability is an important aspect of drug development. In “Big Pharma” there is a tendency to keep all their resources internal; however, some “Big Pharma” companies do outsource i.e. engage consulting firms and contract research organizations. In general, outsourcing provides lower overhead cost and lower head count within the discovery and product development team whilst providing instrumental insight and expertise.

The idea of outsourcing originally started in the 18th century during the industrial revolution, however, the model was redefined in the 1980s and is still being implemented today. The premise of the model (current practice) was that corporations could be more agile and increase profits by focusing on core strengths and relying on external sources to fill gaps. This practice has fundamentally been implemented into almost all current business models within and outside of the pharmaceutical industry. Drug development outsourcing can be leveraged in multiple areas including, but not limited to the areas mentioned previously (i.e. medical writing, regulatory affairs, regulatory operations and project management).

Outsourcing such roles and associated workloads adds value within the development team. When it comes to regulatory affairs in particular, most firms get hired to help a company navigate FDA interactions. As shown in Figure 1, regulatory interactions can be initiated early in the drug development process (e.g Pre-Clinical Research phase) and continue to Post Marketing (Phase 4). The average time to bring a new drug to market is 10 to 15 years; consequently, there are an increasing number of tasks as development progresses.

To support the drug development process, it is important to have an experienced and committed foundational team that generates quality work, operates with integrity and can be integrated into the client’s team. Limiting the number of different parties involved can reduce the risk of prolonged tasks, and other hindrances that may cause setbacks.

The drug development process may seem rather daunting and cumbersome at times given the funding and resourcing challenges. However, with the right team and support, the process can be optimized to maximize the chance of successful development of new medicines. Whether it be a large or small company DLRC’s goal is to support the client’s needs with a flexible approach to help streamline the process.

DLRC’s expertise and flexible working approach ensures the provision of a highly motivated team who interact effectively with clients and regulators globally to:

DLRC consultants have the skills needed to effectively guide clients through product development, from the pre-clinical stage to submission of a marketing application and authorization. To find out how we can support you, contact us.

Published Jul 21, 2025

Published Jul 11, 2025

Published Jul 07, 2025

Published May 29, 2025

Published May 29, 2025

Published May 29, 2025

Published May 29, 2025

Published May 01, 2025

Published Apr 28, 2025